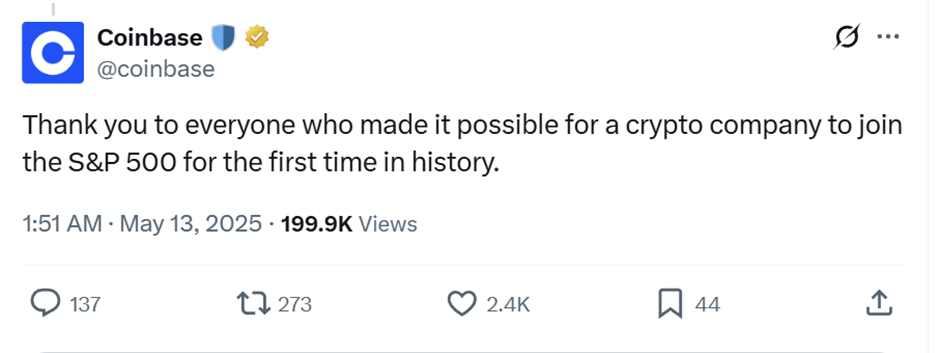

In a historic moment for the crypto world, Coinbase Global Inc. (NASDAQ: COIN), one of the biggest cryptocurrency platforms, has officially joined the S&P 500 – an exclusive list of the 500 most valuable public companies in the US.

Starting May 20, 2025, Coinbase will replace Discover Financial Services, which is being bought by Capital One. This marks the first time a crypto-focused company has made it into this top-tier group – a major win for digital assets.

Why It Matters

The S&P 500 is like the “Wall Street Hall of Fame.” It tracks the 500 largest US companies and is watched closely by investors around the world. Big names like Apple, Microsoft, and Amazon are already on it.

For Coinbase, joining the S&P 500 is a stamp of approval that shows it’s now considered one of the most important companies in the country. It also means that millions of people – even those who don’t invest in crypto – will now own a small piece of Coinbase through retirement accounts, ETFs, or index-tracking funds.

How Did Coinbase Make the Cut?

To qualify, companies must meet certain rules, like:

- Being based in the US

- Making a consistent profit

- Having a large enough stock market value

- Being easy to buy and sell on the stock exchange

Coinbase struggled in 2022 and 2023, with falling crypto prices and regulatory challenges. But it made a strong comeback in 2024 and early 2025. The company reported over $1 billion in profit in the first quarter of this year, helping it meet the criteria.

Coinbase Revenue Sources

Source: Yahoo Finance. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 March 2025.

That turnaround, combined with crypto’s recent rebound, helped push Coinbase over the line.

What This Means for Coinbase

Now that Coinbase is part of the S&P 500, huge investment funds that automatically copy the index will be buying its stock. This can drive the price up and make the stock more stable. After the news broke, Coinbase shares jumped almost 24%.

Coinbase Global, Inc. (COIN): YTD Price (Jan to May 2025)

Source: Yahoo Finance. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 15 May 2025.

Experts believe this could bring billions of dollars in new investments into Coinbase, giving it more power and influence in the traditional finance world.

What This Means for Crypto

The Coinbase victory represents more than a win for the company because it demonstrates that cryptocurrency has entered the mainstream.

Coinbase CEO Brian Armstrong summed it up perfectly:

“Crypto is going mainstream. This inclusion gives more people exposure to digital assets – even passively, through their retirement plans.”

The likelihood is that you are now invested in crypto whether you are into it or not.

What’s Next?

Coinbase’s rise into the S&P 500 could create opportunities for additional crypto companies to enter the index. The move demonstrates how traditional finance and digital assets are rapidly converging for everyday investors.

Love it or hate it – crypto is here to stay. And now it has a seat at the biggest table on Wall Street.